NORBr leverages Elastic to keep payments on track and improve key business metrics

NORBr is the #1 global distributor of payment services for digital merchants, allowing customers to connect, manage, and benchmark all their payment services through a single API and single platform. NORBr creates the perfect match between digital merchants and payment companies via a no-code routing engine to send transactions to the best-performing payment service providers. This allows merchants to focus on their business performance and optimize their payment processing costs.

NORBr was built on the premise that the payment ecosystem is becoming increasingly complicated. For merchants, there is a growing need for orchestration — payment stacks have become very complex and have affected their agility, time-to-market, and overall performance and costs. By offering an automated marketplace, NORBr saves the merchant precious time. Its no-code platform allows customers to be autonomous and manage, in real time, the payment of all their orders in a single place.

Making the data engine run

Critical to NORBr's value proposition is ensuring the NORBr team understands vital business metrics associated with the speed and connectivity of their solution. These essential indicators are based on four different levels:

- NORBr platform: Are the tools and microservices working correctly? The team needs to know 24/7 if something is wrong with the platform.

- Merchant level: Are transactions successful, or are there any abnormalities/issues?

- Payment Service Providers (PSP) level: Does the team need to route to an alternative partner if a particular transaction fails?

- Merchant <-> PSP <-> payment method: Is the specific payment method accepted, and is the whole process working as it should?

NORBr is leveraging Elastic to monitor these metrics and set up alerts when there is an issue. This enables the NORBr team to measure success rates against industry benchmarks and abide by thresholds. Examples of abnormal indicators could include:

- The authorization rate by the merchant is below x% for the last y minutes with a minimum of z transactions

- The average response time for a PSP is above x milliseconds for the previous y minutes with a minimum of z transactions

The above scenarios could indicate a significant problem with the merchant's connectivity or service and warrant immediate attention. These alerts run every minute to enable them to identify potential issues immediately. Then, they can communicate with the merchants and partners, such as PSP or risk assessment solutions. This proactive approach has received excellent feedback from NORBr’s customers.

Leveraging Elastic to keep merchants on track

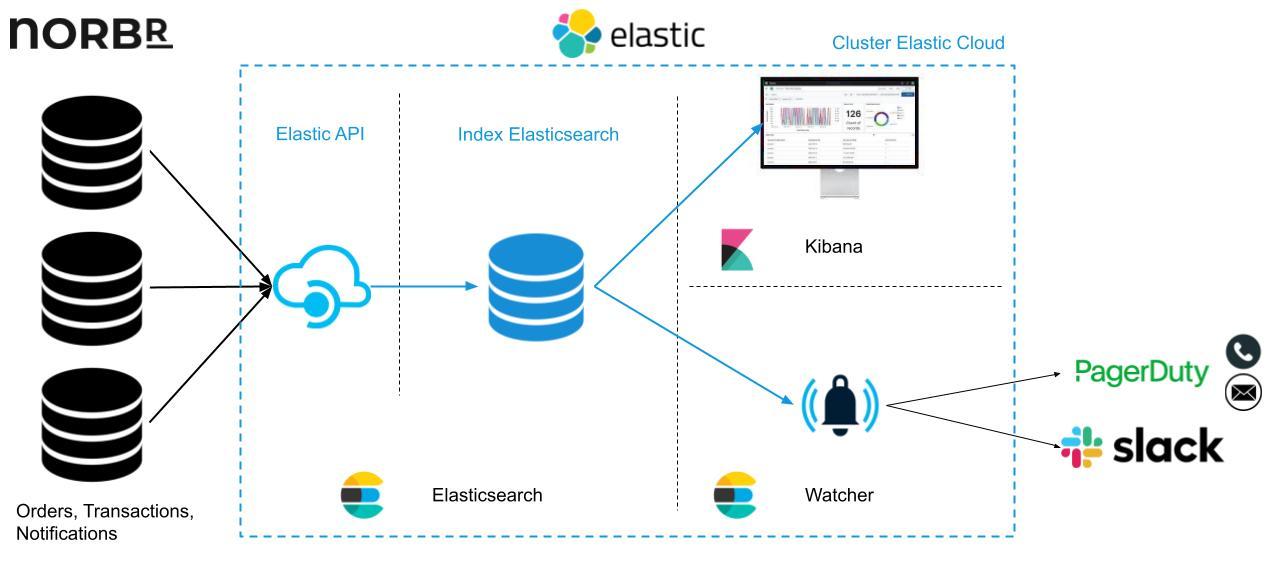

Integrating with Elastic was simple to implement but also very effective. The technical stack is organized as displayed in the graphic below:

In Watcher, NORBr created a dozen "Advanced watches," one by specific scenario. The advanced watches enable the team to write one or more complex queries, compare them, confront the thresholds, and define the actions. Each watch triggers alerts in Slack (for the Tech team) and PagerDuty (business alerts 24/7). In parallel, they set alerts on each platform component, but they’re managed directly in Google Cloud Platform.

Results that matter

The above scenarios enable NORBr to ensure that its platform functions at industry-leading levels. NORBr can also ensure that the performance of PSPs is running as planned and the performance of the payments is optimized:

- All incidents are notified within two minutes (five minutes in NORBr's SLAs).

- The identification of the root cause is managed in less than five minutes.

By leveraging Elastic technology, NORBr can communicate with merchants when there is a problem and maintain its SLAs — enabling NORBr to continue to grow partnerships. Maximizing the uptime of the service through alerting also allows the merchants to ensure they receive the maximum revenue.

The success of working with Elastic has incentivized NORBr to look into other ways of leveraging the technology. The NORBr team is currently working on a new AI algorithm, and there are potential opportunities to leverage Elastic as part of that process.

Additional resources

- Check out NORBr’s website to learn more about the company’s offering.

- Learn about the features and benefits of Elastic Enterprise Search.

- See how financial institutions cash in on their data with Elastic.

- Results that matter: How Elastic helps our customers create value and drive success