Observability trends for 2026: Maturity, cost control, and driving business value

_(1).png)

The observability landscape has undergone a fundamental transformation over the past several years. In a recent report, The Landscape of Observability in 2026: Balancing Cost and Innovation conducted by Dimensional Research and sponsored by Elastic, over 500 IT decision-makers were surveyed. It revealed that observability has definitively transitioned from an optional capability to a mission-critical business function. This shift brings both opportunities and challenges as organizations work to optimize their investments and extend observability benefits beyond the walls of traditional IT operations. Here’s what to expect in the upcoming year.

Accelerating observability maturity for all organizations

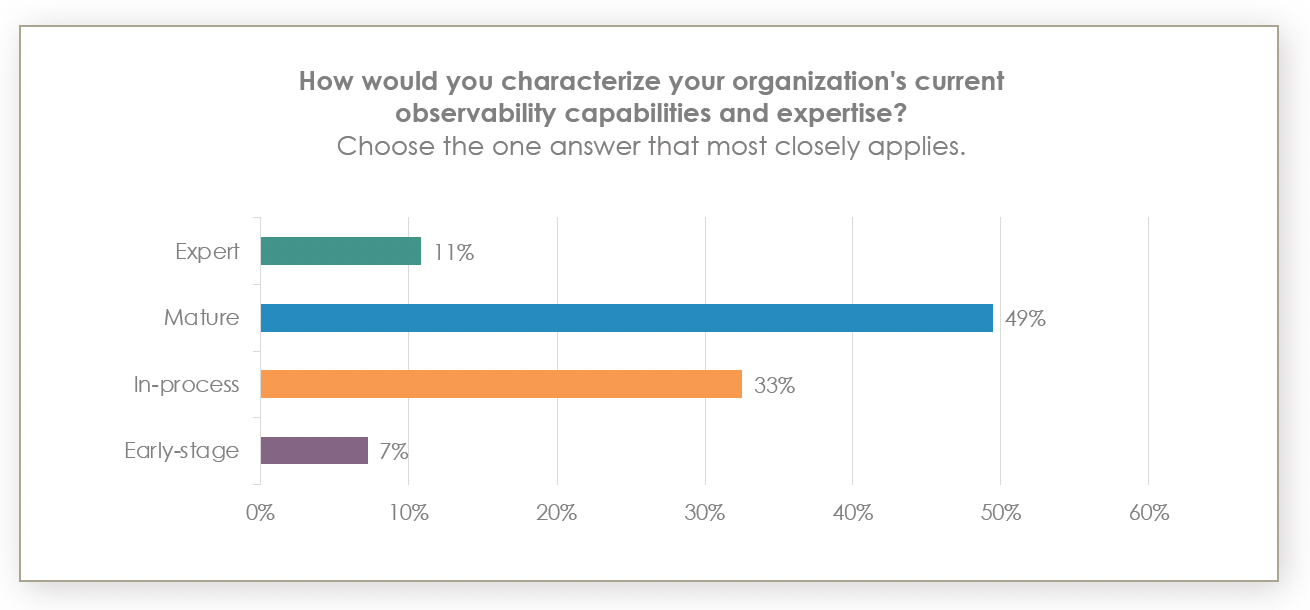

Enterprise observability practices are advancing at a remarkable pace. The data demonstrates significant year-over-year progress, with 60% of organizations now characterizing their observability practices as mature or expert compared to just 41% in the previous year. This represents a 46% increase in organizational maturity within a single year.

The distribution of maturity levels provides additional insight into this observability evolution.

11% of organizations classify themselves as experts, having implemented comprehensive data collection with modern AI-based technologies.

49% identify as mature, using AIOps and establishing or considering cross-functional centers of excellence (CoEs).

33% describe themselves as in-process, actively working to use modern technologies for efficiency, scale, and root cause analysis.

Only 7% remain in early stages of adoption, primarily relying on log data.

This rapid maturation reflects substantial investments in tooling, expertise, personnel, and organizational culture. Organizations are moving beyond basic monitoring and reactive incident response toward predictive capabilities and comprehensive visibility across their complex technology environments.

The cost management imperative for observability

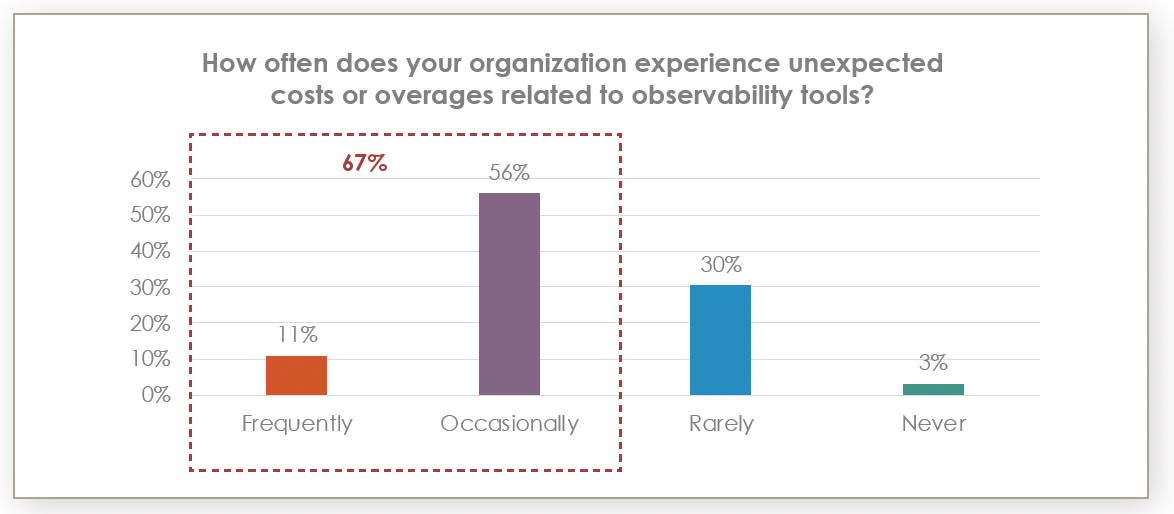

As observability practices mature, cost management has emerged as a critical priority. The research reveals that unexpected costs and overages are endemic to observability implementations with 97% of organizations having experienced cost surprises. More concerning, 67% report that these unexpected costs occur regularly, including 11% who encounter them frequently.

The prevalence of cost overages correlates strongly with organization size. Among companies with more than 20,000 employees, 18% report frequent unexpected costs, compared to only 4% at organizations with 500–1,000 employees. These surprise overages may stem from multiple sources, including unplanned data volumes, cloud infrastructure usage spikes, unexpected audits, and variable licensing models.

Observability budgets

Leadership expectations around observability spending are shifting accordingly. More than half (54%) of IT decision-makers report increasing requests from leadership to justify observability expenses. This scrutiny is driving changes in how organizations approach observability budgets. Only 17% view observability as a growth area requiring new investment while 13% consider it an established function suitable for cost reduction. The majority (70%) seek to optimize existing spending by identifying efficiencies rather than pursuing expansion or contraction strategies. Essentially, observability has shown its operational value, but the appetite to invest more may be slowing down.

How organizations are responding

Organizations are responding with concrete cost control initiatives. An overwhelming 96% are actively taking steps to control observability costs. Here are some of the most common approaches:

51% are consolidating existing toolsets.

41% are using lower-cost tools for less-critical systems.

37% are using data transformation tools.

29% are moving observability workloads from cloud to on-premises.

However, many organizations are pursuing strategies that may introduce risk and increase observability gaps in their cost control measures. Some common tactics would include deploying observability only to critical environments (42%) and reducing the number of agents or data collectors deployed (33%). While these approaches reduce immediate expenses, they may create vulnerabilities, as issues in noncritical environments can cascade into production systems.

An increasing challenge to show business impact

Another critical evolution in observability practice involves expanding focus beyond purely operational metrics toward demonstrating business impact. However, this transition remains incomplete across most organizations.

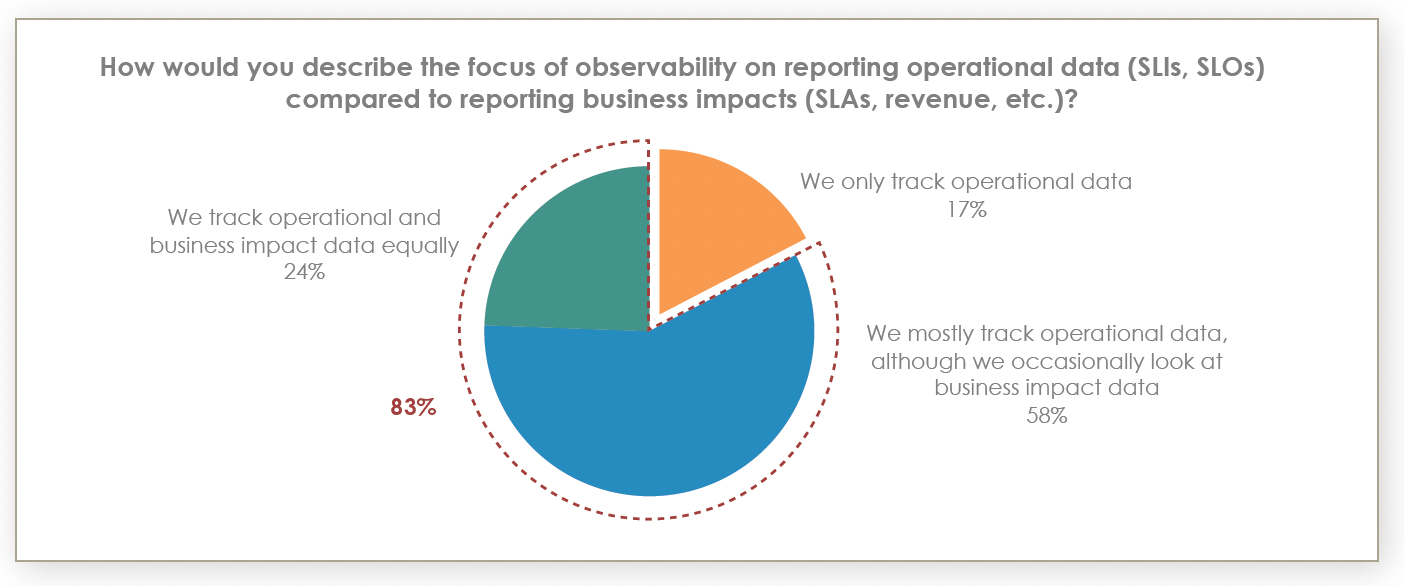

Only 17% of observability teams focus exclusively on operational data, such as Service Level Indicators (SLIs) and Service Level Objectives (SLOs). At the opposite end of the spectrum, 24% of respondents have elevated business impact metrics, including Service Level Agreements (SLAs), revenue impact, and customer experience, to equate the importance of operational data. The majority (58%) maintain a primary focus on operational metrics while treating business impact as a perk.

The gap between aspiration and capability is evident in reporting practices. While 93% of organizations report financial and business impact to leadership in some form, only 19% do so regularly as part of established processes. Most organizations report impact occasionally (43%) or only when specifically requested by leadership (31%).

Maturity level strongly correlates with reporting frequency. Among expert observability teams, 47% regularly report business impact to leadership compared to 20% of mature teams, 11% of in-process teams, and just 5% of early-stage teams. This pattern suggests that as organizations develop more sophisticated observability practices, they also build the infrastructure and processes necessary for business impact reporting.

The challenge of reporting business impact extends beyond cultural factors to practical capabilities. Only 40% of organizations can quickly assemble a comprehensive report on the financial and business impact of a major outage. Half (49%) indicate that producing such a report would require significant effort while 8% consider it impossible with current capabilities.

Democratization of observability data

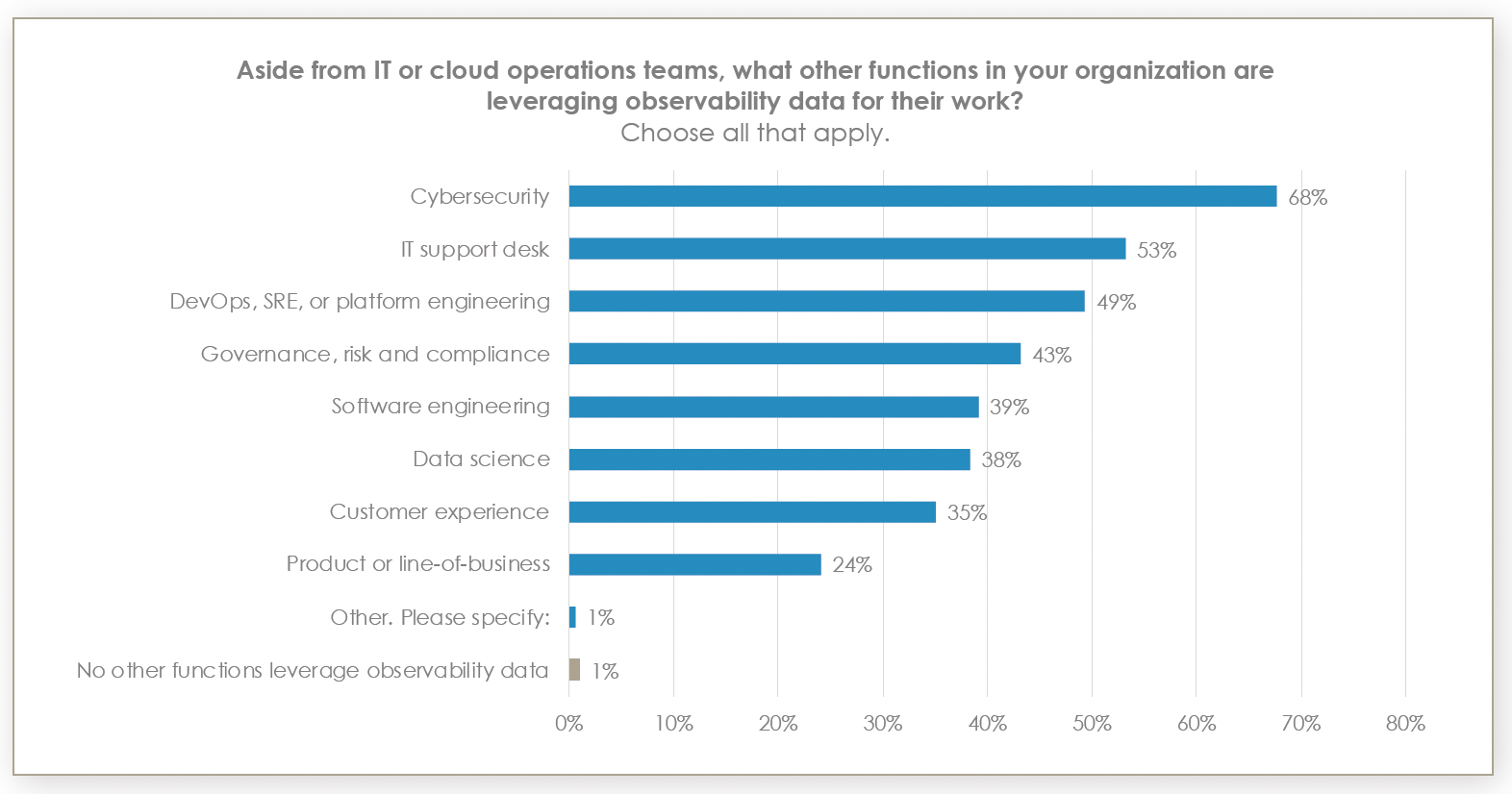

Observability data is increasingly serving stakeholders beyond traditional IT and cloud operations teams. For 99% of companies, additional internal teams use observability data with 72% supporting three or more teams beyond core IT operations.

Cybersecurity teams represent the most significant additional user base at 68% of organizations. This convergence of observability and security reflects the complementary nature of these disciplines with observability data supporting multiple security functions. The most common security applications include incident response (61%), alert correlation (53%), Zero Trust compliance and auditing (45%), real-time compliance monitoring (45%), and audit trail generation (40%).

Broad utilization demonstrates that observability investments generate value well beyond their traditional scope. Other teams actively using observability data include:

IT support desks (53%)

DevOps and site reliability engineering (49%)

Governance, risk, and compliance (43%)

Software engineering (39%)

Data science (38%)

Customer experience (35%)

Product or line-of-business functions (24%)

The relationship between observability and security teams generally functions well, though opportunities for improvement exist. Only 19% characterize the relationship as poor or problematic, but 63% acknowledge room for improvement. As security teams become increasingly dependent on observability data for critical functions, optimizing these cross-functional relationships and collaboration becomes essential.

Meeting compliance and governance requirements

The adoption of observability data by governance, risk, and compliance teams at 43% of organizations signals another important trend. Observability platforms are increasingly serving regulatory and compliance needs, providing audit trails, supporting regulatory reporting, and demonstrating adherence to various compliance frameworks.

This expanded role requires careful consideration of data governance, access controls, and presentation layers. Different stakeholder groups require different views into the same underlying observability data. For example, compliance teams need specific evidence of control effectiveness, security teams need threat intelligence, and business teams want customer-impact metrics.

Organizations with mature observability practices are better positioned to serve these diverse needs. They have typically developed the data architecture, access mechanisms, and reporting capabilities necessary to support multiple constituencies while maintaining appropriate security and governance controls.

Strategic implications for observability and conclusion

The research findings point to several strategic imperatives for observability leaders.

Cost optimization must be pursued without compromising coverage or creating operational blind spots. Consolidating tools, optimizing data volumes, and improving infrastructure efficiency represent sound approaches, while eliminating observability from noncritical environments will likely introduce risk.

Organizations must accelerate the development of business impact reporting capabilities. The gap between current state and desired state is significant with most organizations lacking the infrastructure and processes to quickly demonstrate business value. Building these capabilities requires both cultural change and technical implementation.

The democratization of observability data across multiple teams creates opportunities to maximize return on investment. However, serving diverse stakeholders effectively requires thoughtful data governance, appropriate access controls, and customized presentation layers.

Finally, as observability teams face increased scrutiny of expenses and demands for business justification, they must evolve from technical and operational experts to strategic business partners. This metamorphosis will require developing an understanding of business metrics, building strong cross-functional relationships, and consistently demonstrating how observability investments support organizational objectives.

Organizations that effectively navigate these challenges — controlling costs without sacrificing coverage, clearly demonstrating business value, and serving diverse stakeholder needs — will establish observability as an indispensable strategic capability and advantage. The rapid maturation observed over the past year suggests that organizations are already making this transition, setting a standard that others will need to meet. Here’s to the new year for you and your observability team!

Download the full report: The Landscape of Observability in 2026: Balancing Cost and Innovation.

The release and timing of any features or functionality described in this post remain at Elastic's sole discretion. Any features or functionality not currently available may not be delivered on time or at all.