Board members

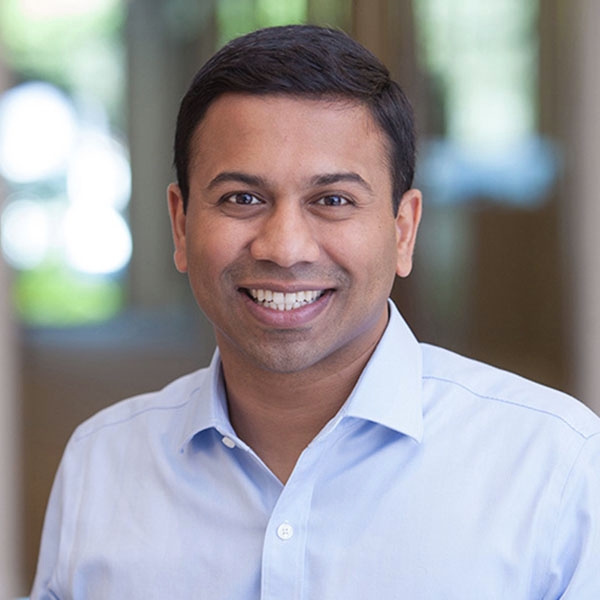

Chetan Puttagunta

Chetan Puttagunta

Chetan Puttagunta joined Benchmark in 2018, after spending seven years as a general partner at NEA, where he focused on enterprise software, and currently serves as Elastic's Chairman of the Board and Lead Independent Director. His investments at NEA included MuleSoft, Elastic, MongoDB, Acquia, Reltio, Placester, Heap, Sentry, Swiftype, Forter, ScoutRFP, Canopy, and Folloze. He was previously involved with Gaikai (acquired by Sony). Prior to NEA, Chetan was an investor with H.I.G. Capital's Leveraged Buyout Group and a technology investment banker with Houlihan Lokey. He holds a BS degree in electrical engineering from Stanford University.

Ash Kulkarni

Ash Kulkarni

At Elastic, we see endless possibilities in a world of endless data. As CEO of Elastic, Ash Kulkarni’s priority is to drive innovation, and he has the pleasure of working with the bright minds at Elastic to create products and solutions that use the power of search to help its customers and community turn possibilities into results. Ash joined Elastic as chief product officer in 2021 and prior to that held senior product leadership and management roles at McAfee, Akamai, Informatica, and Sun Microsystems. He and his family live in San Francisco and enjoy hiking, skiing, and exploring national parks in their free time.

Shay Banon

Shay Banon

As a founder of Elastic and CTO, Shay Banon has been fascinated with search ever since he tried to build a recipe app for his wife in 2004, a journey that led to him writing the first few lines of code of Elasticsearch in 2009 and later founding Elastic in 2012. Shay believes finding beauty and excelling is a combination of perspective and grit. As someone who got into computers by counting the number of job postings in the newspaper, he loves building things—a product, a community, or a company and the process of acquiring the knowledge to do so.

Steven Schuurman

Steven Schuurman

Steven Schuurman was one of the four co-founders of Elastic, serving as Chief Executive Officer for the first five years of the company. Prior, Steven was Chief Executive Officer of Orange11, which was acquired by Trifork A/S (TRIFOR.CO). In addition, he co-founded the internationally renowned open source software vendor SpringSource, one of the most successful open source companies in history. SpringSource is the world's leading Enterprise Java middleware company, and was acquired by VMware (VMW) in 2009.

Caryn Marooney

Caryn Marooney

Caryn Marooney led global communications for Facebook and its family of apps including Instagram, Messenger, WhatsApp, and Oculus. Prior to joining Facebook, Caryn co-founded OutCast Communications, one of Silicon Valley's premier technology communications firms. As co-founder, partner and CEO, Caryn was responsible for planning and executing communications strategies for companies of every size, including Amazon, Netflix, Salesforce, and VMware. Caryn was named multiple times to PRWeek's annual Power List, as one of the 50 most powerful people in public relations.

Caryn is also an advisor for UCSF Benioff Children's Hospital. She holds a BS degree from Cornell University.

Alison Gleeson

Alison Gleeson

Alison Gleeson was Senior Vice President of Cisco's Americas organization, responsible for more than $25 billion in annual sales and leading nearly 9,000 employees across 35 countries including Canada, Latin America, as well as segments such as US Commercial, US Public Sector, and the Global Enterprise Segment focused on Cisco's top 28 customers. A passionate speaker about the role of technology in enabling business transformation and empowering women in technology, Alison has received Connected World's "Woman of IoT" award, Diversity Best Practice's "Above and Beyond Legacy Award," and Michigan Council for Women in Technology's "Woman of the Year Award." Alison currently serves on the board of 8X8 and Zoominfo, and on the Advisory Board of the Eli Broad College of Business at Michigan State University, her alma mater. Alison holds a BA in marketing from Michigan State University.

Shelley Leibowitz

Shelley Leibowitz

Shelley Leibowitz is a prominent technology advisor, director, and thought leader. She has spent her career at the intersection of financial services and technology, with both private sector and public sector experience. After more than two decades of Chief Information Officer roles at top tier financial services companies, she served as Group-wide Chief Information Officer for the World Bank.

Shelley is a seasoned corporate director and in addition to Elastic, she currently serves on the boards of Morgan Stanley and several privately held companies in the fintech and information security arena. She also advises companies in areas of digital transformation, IT portfolio and risk management, information security and digital trust, performance metrics, and effective governance.

She is a lifetime member of the Council on Foreign Relations, on the NY Board of the National Association of Corporate Directors, on the Advisory Board for the Center for Development Economics at Williams College, on the CNAS Council, and on the NY Board of BuildOn, a not-for-profit that runs service and learning programs in urban high schools across the country.

Sohaib Abbasi

Sohaib Abbasi

Sohaib Abbasi previously served as the CEO and President of Informatica Corporation, where he led the company to five-fold growth and established leadership in multiple software categories, including data integration, data quality, master data management, and cloud data integration.

Prior to Informatica, Sohaib was the Senior Vice President of the Oracle Tools Division and Oracle Education at Oracle Corporation. Sohaib joined Oracle in 1982 when it was a 30-person startup and was instrumental in growing the business from $4M to more than $9B in annual revenue. He also envisioned and launched the Oracle Tools business, which he grew from zero to $3.75B in cumulative license revenues.

In addition to serving on Elastic’s board, he currently serves as Chairman of the Board of Forecast.app and as a member of the Board of Udemy, Inc., an online global learning platform. He also serves as a Senior Advisor at TPG (Texas Pacific Group), Royal London Technology Group, and Balderton Capital UK. He previously served on the boards of directors of Peakon, Nutanix, McAfee, New Relic, Informatica, and Red Hat. In 2010, Sohaib received the Chairman of the Year Award from the American Business Awards®.

Sohaib has more than 30 years of enterprise technology leadership experience and was previously ranked second in Bloomberg’s list of all-time business turnaround CEOs in technology. Additionally, Glassdoor ranked him as one of the five best CEOs to work for in the enterprise software industry.

Sohaib graduated with honors from the University of Illinois at Urbana-Champaign, where he earned both a BS and MS in Computer Science.

Paul Auvil

Paul Auvil

Paul Auvil brings more than 35 years of finance, technology and corporate leadership experience to the Elastic Board of Directors. He served as the Chief Financial Officer of Proofpoint, Inc., a provider of security-as-a-service solutions from March 2007 until March 2023. From September 2006 to March 2007, he was an entrepreneur-in-residence at Benchmark Capital, a venture capital firm. From August 2002 to July 2006, he served as the Chief Financial Officer at VMware, Inc., a computing virtualization company. Paul has previously served on the Boards of One Medical, OpenTV, Marin Software, and Quantum Corporation. He earned a Bachelor degree in Electrical Engineering from Dartmouth College and a Master of Management degree from the Kellogg Graduate School of Management at Northwestern University.