ING's bold leap into the future: Building a global, cloud-based financial messaging system with Elastic

ING Group is a Dutch-based multinational banking and financial services corporation serving more than 38 million customers globally. It’s one of the biggest banks in the world, consistently ranking among the top 30 largest banks globally.

At ING, our 20-year-old COBOL-based financial messaging system — which provides electronic instructions to enable financial transactions between banks and customers — is slowly becoming obsolete and difficult to integrate. COBOL is declining in popularity among developers, and many programmers with COBOL experience are retiring or will soon.

In addition, we’re seeing competition from fintech startups that are lowering the cost of financial messaging while at the same time accelerating processing times.

To ensure ING continues as a global financial leader, it became imperative for us to build a new cloud-technology-based financial messaging system to facilitate financial transactions between banks, customers, and third parties.

The Belgian branch of ING was tasked with the challenge of building this from scratch. We chose Elastic® because we wanted to future-proof the mission-critical payments processing platform with a widely used technology that scales well as we add more customers and increase load.

Choosing this solution was natural because ING’s global headquarters is working on providing the Elastic Stack as a Service to the rest of our organization to capitalize on the many use cases and value that can be achieved with Elastic.

What is financial messaging?

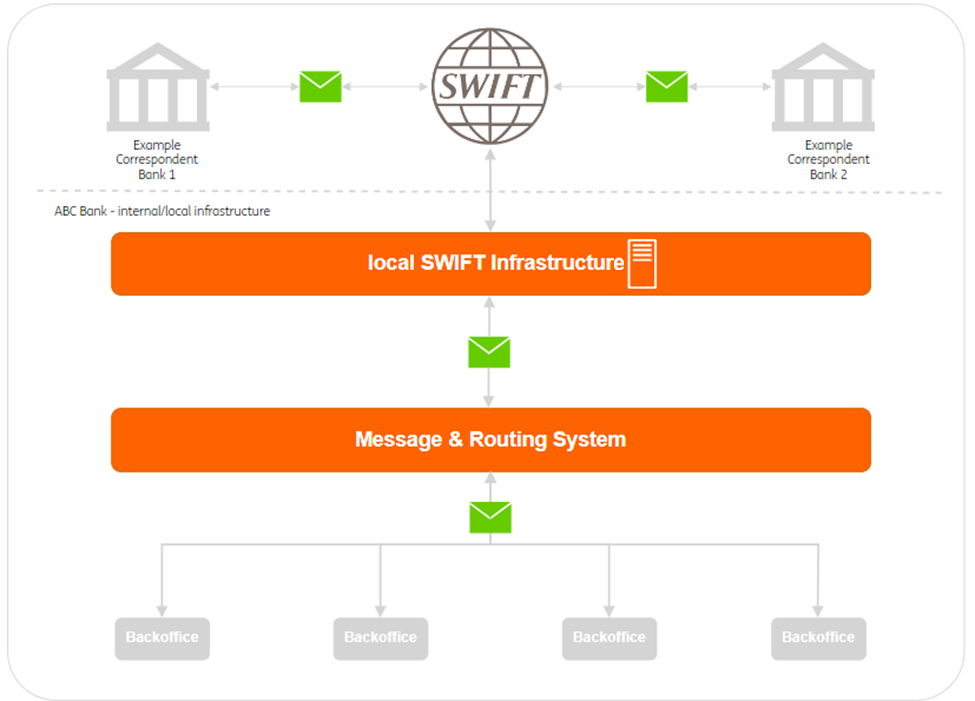

Financial messaging is a niche and specialized activity in payment processing. It’s a complex and quickly evolving ecosystem where fast and guaranteed delivery is crucial to the success of ING and its customers.

A financial message, in its most basic form, is one that tells one bank to transfer money. Payment messages, which ING routes through the SWIFT Network to external banks, include just about any type of monetary transaction you can imagine. ING is processing 1.5 million financial messages in at least 200 different formats every day with our COBOL platform.

Lapses in the message flow must raise alerts and require diagnostic and resolution of issues in a timely manner. Fixing lags quickly is critical — payments between banks are settled every day, and any miss of cutoff times can lead to financial loss.

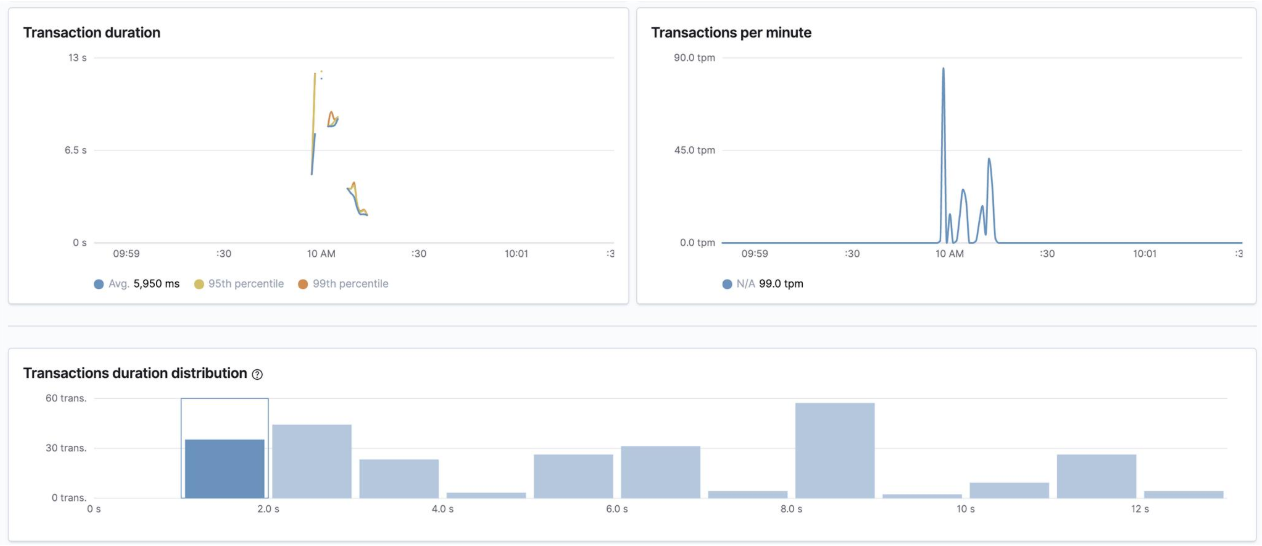

Under the new system with messaging data stored in Elasticsearch®, Elastic APM and Kibana® help us answer and visualize those questions quickly, which in the end increases customer loyalty and trust.

The log data surrounding financial messaging must be stored for 10 years to comply with data retention regulations. These logs are ingested with Logstash and stored in Elasticsearch. The data is available to detect illegal activity, assure delivery, and settle disputes and other issues. Messaging is up and running 24/7 around the globe.

Elastic is part of ING’s technology stack

Our ongoing upgrade to the Elastic Stack is necessary for reasons beyond competition from startups and COBOL’s decline. That’s because our on-premises platform is becoming less interoperational with the technologically evolving and ubiquitous SWIFT network, which is leveraged by banks across the globe, and also uses Elastic.

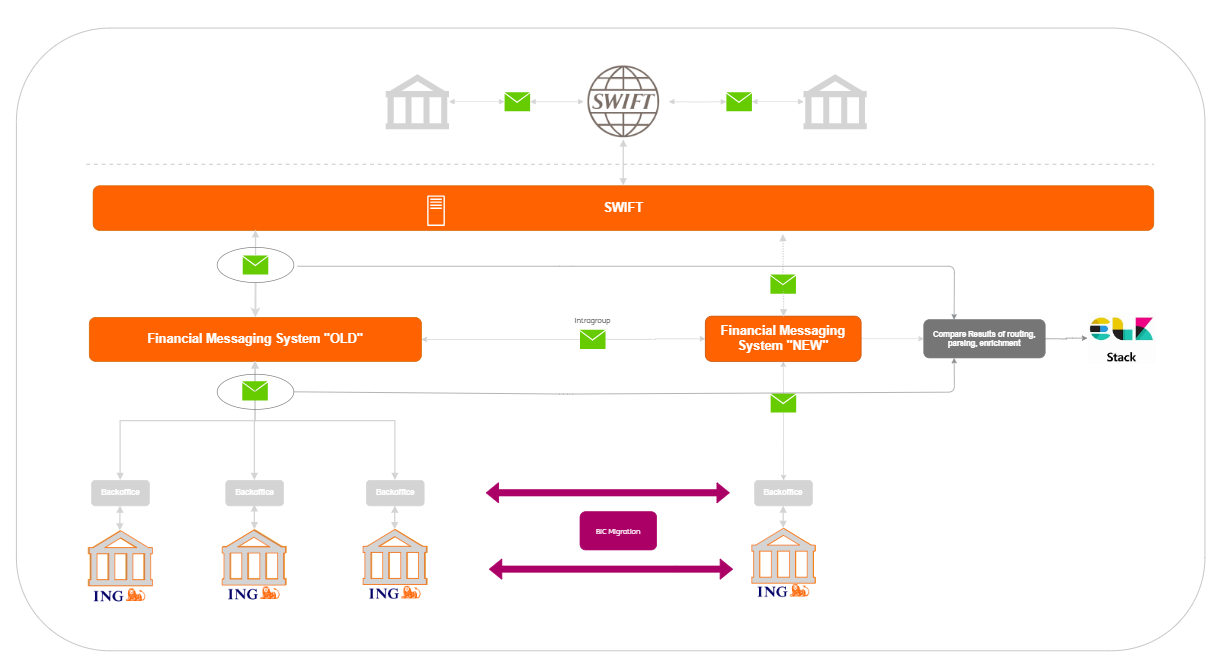

For now, the newly developing messaging system is mirroring our operating COBOL platform. This way, we can test, with the assistance of Elastic Observability, for backwards compatibility to ensure that the new financial messaging system behaves the exact same way as our legacy system.

What this means is that Elastic is not only a backbone component of our new payment processing system, but it is also monitoring whether this new payment system is mirroring and backwards compatible with our COBOL system.

This flexibility of Elastic gives us great confidence that the upcoming migration to the new system will be as low-risk as possible.

4 use cases that define success

We have defined success, beyond the ability to scale, by delivering four use cases with Elastic:

- Elasticsearch stores payment transaction history for 10 years, ensuring that we remain compliant.

- Kibana enables a live view of our system, with the ability to immediately answer, “Where’s my payment?”

- Elastic APM tracks and traces bottlenecks to ensure message delivery.

- Elastic APM monitors system performance and hiccups.

Our COBOL platform took 20 years to build, and it is mission-critical to ING’s success. It is imperative that ING’s successor system is built and operates successfully. To make the changeover as low-risk as possible, we expect to begin slowly migrating over a period of time.

When we fully migrate, we’re not sure what the financial messaging space might look like compared to today. What we do know is that we can meet the future with Elastic’s flexibility and scalability.

This is why ING has embraced Elastic, to future-proof its mission-critical financial message processing platform.

Learn more about how the Elastic Stack can help modernize your business.